Take advantage of Out Of Gold Investment Guide

페이지 정보

본문

Nearing its third birthday, GLD just reported large holdings of 19.3m ounces of gold held in belief for its investors. GLD’s large volume spikes additionally provide insights into GLD traders’ habits and therefore impression on the gold value. That is evidenced by GLD’s stable bullion holdings during selloffs even despite these large volume spikes. Gold’s return within the atmosphere consensus in 2023 is likely to be stable however optimistic, because it faces competing crosswinds from its drivers. Considering gold’s rising volatility, GLD’s custodians have performed an outstanding job of sustaining tight GLD monitoring of gold. So like every ETF on the planet, they cost an affordable management charge to maintain GLD and keep it tracking gold. Since GLD launched I have been very involved in observing its efficiency relative to gold technically. Investment was again hampered by liquidity restrictions as investors who hold equities and actual estate suffer from their poor performance. While I definitely imagine that the daybreak of Stage Two world gold funding demand was the primary driver by far on this latest massive gold upleg, after learning this chart I consider that GLD was a peripheral factor too. So if you're a mainstream inventory investor who's fascinated by having some gold exposure, GLD does indeed observe gold well sufficient to be a viable different to all the hassles and enormous commissions involved in shopping for futures or bodily gold coins.

I had expected a distinct consequence, that physical gold dips would result in sufficient GLD selling that the ETF would have to sell a few of its own price gold to maintain GLD’s worth monitoring gold. Despite such a statistical mirroring, GLD’s monitoring of gold has loosened barely. To guage GLD’s monitoring of gold, its whole mission in life, first try the yellow GLDx10 line overlaying the blue gold worth. By shunting stock demand and capital into gold, gold’s bull market must grow even more powerful with broader participation. But of course feeding stock-market capital into the gold market is a double-edged sword. When considering your portfolio allocation, it is necessary to determine the suitable stability of gold and silver based mostly in your particular person monetary goals and threat tolerance. And whereas we did see this to some extent in GLD, its quantity waned a bit during consolidations, it was still rising on steadiness.

I had expected a distinct consequence, that physical gold dips would result in sufficient GLD selling that the ETF would have to sell a few of its own price gold to maintain GLD’s worth monitoring gold. Despite such a statistical mirroring, GLD’s monitoring of gold has loosened barely. To guage GLD’s monitoring of gold, its whole mission in life, first try the yellow GLDx10 line overlaying the blue gold worth. By shunting stock demand and capital into gold, gold’s bull market must grow even more powerful with broader participation. But of course feeding stock-market capital into the gold market is a double-edged sword. When considering your portfolio allocation, it is necessary to determine the suitable stability of gold and silver based mostly in your particular person monetary goals and threat tolerance. And whereas we did see this to some extent in GLD, its quantity waned a bit during consolidations, it was still rising on steadiness.

GLD’s variances on balance are so tight that they solely reflect this management charge. GLD, like every ETF, has to fund its personal management and operation bills. The preferred ETF at present is the PowerShares QQQ which tracks the NASDAQ 100. Because the elite ETF, it is considered the most effective within the business. The currently fashionable angle toward the business cycle stems, truly, from Karl Marx. Just this week my enterprise associate Scott Wright finished a model-new report on our favorite 20 gold producers. After its birth in November 2004, GLD’s holdings rocketed from 8 tonnes to 100t in its first week of buying and selling. While it coated the blue gold line above perfectly in its first yr, since then GLD’s small however noticeable deviation from the metallic is definitely growing. The British sovereign was first produced in 1489 England, as ordered by King Henry the VII. More than 1 billion gold sovereign coins have been minted. This course of takes GLD demand and shunts it into the bodily world by using this newly-issued inventory capital to buy real gold.

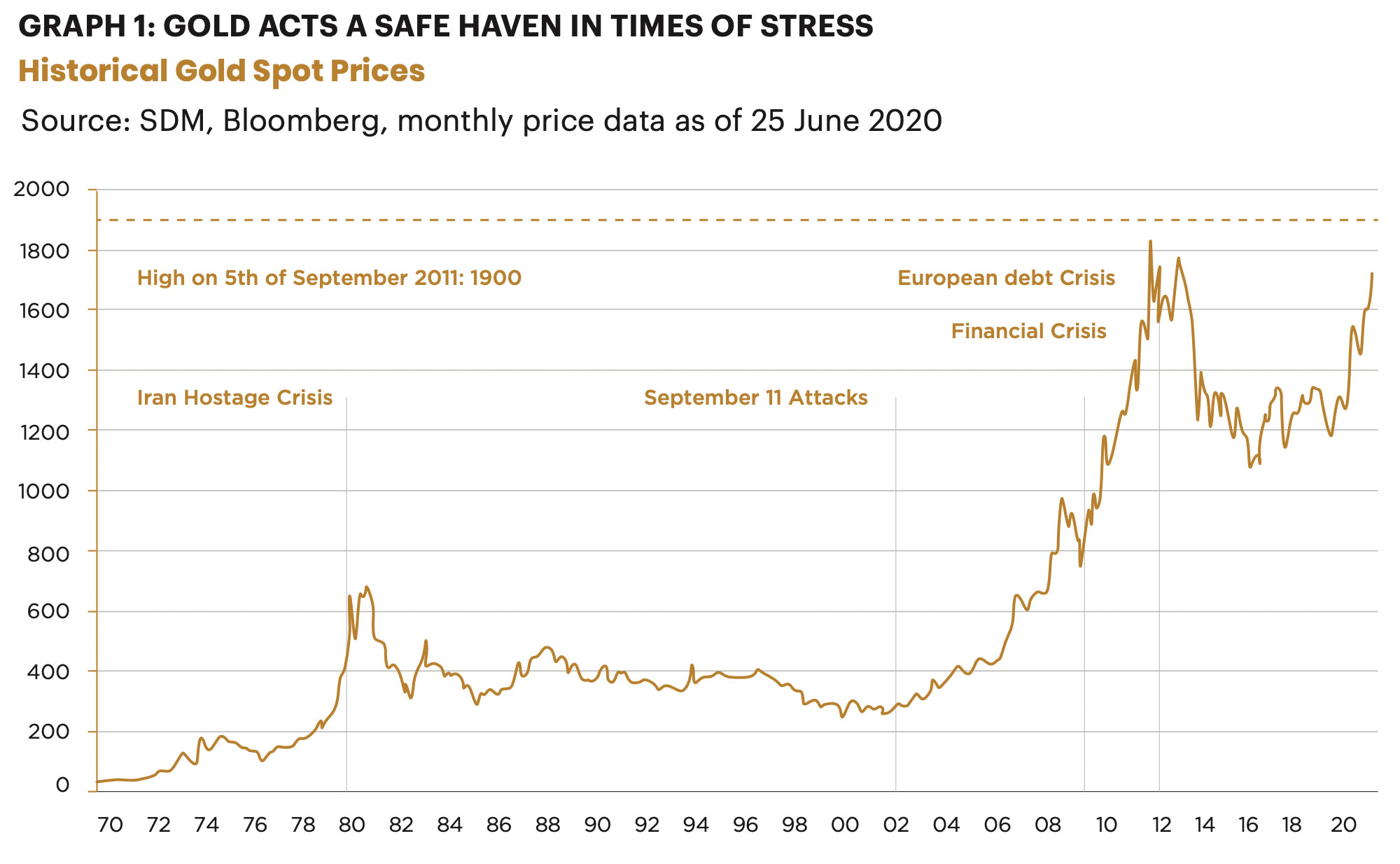

Capital quantity should even be considered. And despite GLD’s large gold holdings, it continues to be vanishingly small compared to stock-market capital. In this article, we will explore a few of the important thing elements that affect gold prices immediately. In order to perform this it points new shares of GLD to soak up the surplus demand and stabilize costs. This chart is essentially the most fascinating of these three charts for me because it shows the GLD ETF getting larger and bigger whilst gold drifted listlessly for nearly 10 months. For those who examine the final couple months or so in this chart above, this has just happened and it contributed to probably the most spectacular gold upleg of this whole bull to this point. So it begins promoting physical gold in London which places pressure on spot gold prices. Factors similar to world financial circumstances, central financial institution policies, provide and demand dynamics, as well as investor sentiment and speculation all contribute to the ever-altering landscape of treasured metal prices. One among the elemental components that have an effect on the costs of gold and silver is the basic economic precept of provide and demand. When GLD is threatening a disconnect from gold, the trust waits till the end of the day to see how GLD demand and supply stacks up in opposition to bodily demand and supply.

In case you cherished this information as well as you would like to be given more details with regards to أسعار الذهب اليوم في الكويت kindly stop by the internet site.

- 이전글20 Fun Facts About Black Retro Fridge Freezer 25.01.05

- 다음글Green Retro Fridge Freezer Tools To Simplify Your Day-To-Day Life 25.01.05

댓글목록

등록된 댓글이 없습니다.