Minimizing Tax Liability with Approved Investments

페이지 정보

본문

Personal finance hinges on effective tax planning, and reducing tax liability most effectively comes from smart investment choices.

In numerous nations, specific investment categories are granted special tax treatment—commonly known as "approved" or "qualified" investments.

These instruments are designed to encourage savings for specific purposes such as retirement, education, or home ownership, and they offer tax incentives that can greatly reduce the tax you owe annually.

Why Approved Investments Matter

Tax incentives on approved investments are offered by governments for various reasons.

First, they support long‑term financial stability by motivating people to set aside funds for future needs.

Secondly, they aid in achieving social goals, such as offering affordable housing or maintaining a steady workforce of skilled workers.

Finally, they offer a way for investors to reduce their taxable income, defer taxes on investment gains, or even receive tax‑free withdrawals under certain conditions.

Common Types of Approved Investments

1. Retirement Accounts

In the U.S., 401(k) and IRA accounts serve as classic examples.

Contributions to a traditional IRA or a 401(k) reduce your taxable income in the year you invest.

Roth IRAs, on the other hand, are funded with after‑tax dollars, but qualified withdrawals in retirement are tax‑free.

Many other countries have similar plans—such as Canada’s Registered Retirement Savings Plan (RRSP) or the United Kingdom’s Self‑Invested Personal Pension (SIPP).

2. Education Investment Plans

529 plans in the U.S. enable parents to save for their children’s college needs, with tax‑free growth and withdrawals on qualified education expenditures.

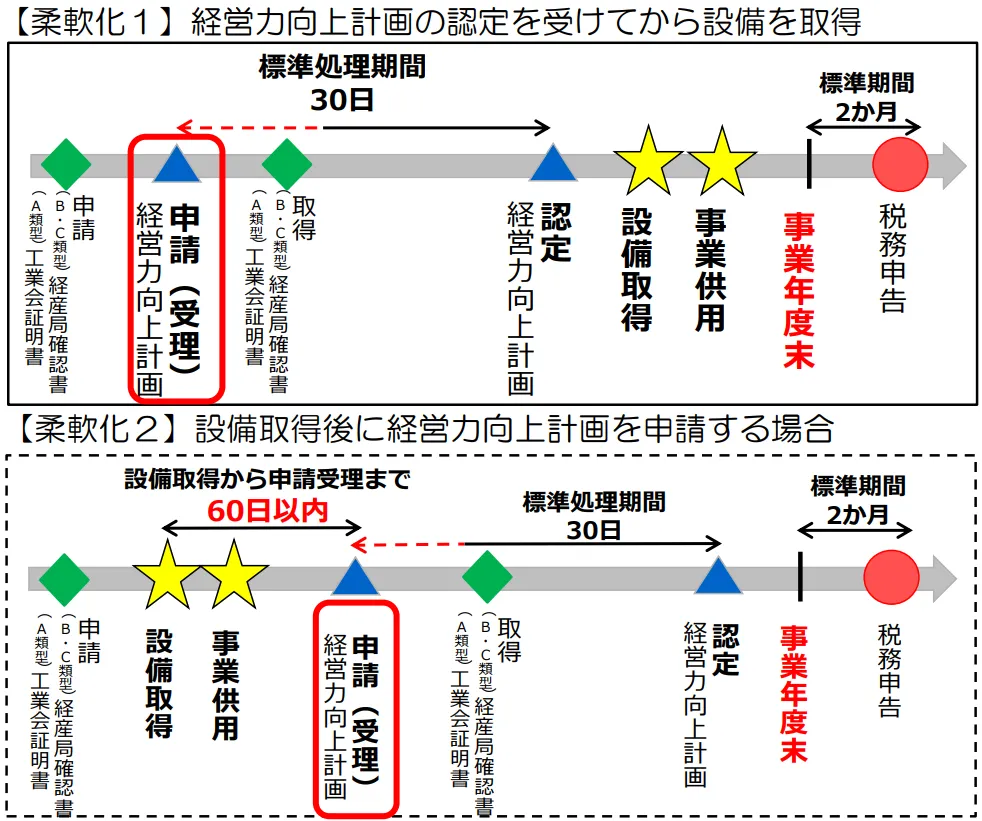

Comparable programs are offered around the world, 中小企業経営強化税制 商品 like the Junior ISAs in the U.K. and the RESP in Canada.

3. Health‑Related Investment Accounts

HSAs in the U.S. offer three tax perks: deductible contributions, tax‑free growth, and tax‑free withdrawals for qualified medical costs.

Other countries provide similar health‑insurance savings schemes that lower taxes on medical expenses.

4. Home Ownership Savings Schemes

Some countries offer tax‑advantaged accounts for first‑time home purchasers.

For instance, the U.K. has the Help to Buy ISA and Lifetime ISA, while in Australia the First Home Super Saver Scheme allows individuals to contribute pre‑tax superannuation funds toward a deposit on a first home.

5. Green Investing Vehicles

Governments often promote eco‑friendly investments with incentives.

In the U.S., green bonds and renewable energy credits might grant tax credits or deductions.

Similarly, in the EU, green fund investments can attract reduced withholding tax rates.

Key Strategies for Minimizing Tax Liability

1. Maximize Contributions

The simplest approach is to contribute the full allowable limit to each approved account.

Because many of these accounts accept pre‑tax contributions, your invested money is taxed later—or, for Roth accounts, never taxed again.

2. Harvest Tax Losses

If you hold approved investments that have declined in value, you can sell them at a loss to offset gains in other parts of your portfolio.

This tax‑loss harvesting can lower your tax bill, and excess loss may carry forward against future gains.

3. Plan Withdrawal Timing

Such accounts typically permit tax‑efficient fund withdrawals.

When retirement income is expected to dip, withdrawing from a traditional IRA during those years may be wise.

Alternatively, Roth withdrawals are tax‑free, so converting a traditional IRA to a Roth in a low‑income year can be advantageous.

4. Leverage Spousal Contributions

In many jurisdictions, spousal contributions to retirement accounts can be made in the name of the lower‑earning spouse.

It balances tax burdens between spouses and raises overall savings while cutting taxable income.

5. Use the "Rule of 72" for Long‑Term Gains

Approved accounts usually grow through long‑term compounding.

The Rule of 72—dividing 72 by the annual growth rate—provides a quick estimate of how long it takes for an investment to double.

Longer growth periods defer more taxes, especially within tax‑deferred accounts.

6. Keep Up with Legislative Updates

Tax laws change over time.

New tax credits may be introduced, or existing ones may be phased out.

Reviewing strategy with a tax professional ensures compliance and maximizes benefit.

Practical Example

Consider a 30‑year‑old professional making $80,000 annually.

You decide to contribute $19,500 to a traditional 401(k) (the 2024 limit), and an additional $3,000 to a Health Savings Account.

This cuts your taxable income to $57,500.

With a 24% marginal rate, you save $4,680 in federal taxes that year.

Furthermore, the 401(k) balance grows tax‑deferred, potentially earning 7% annually.

In 30 years, that balance could triple, and you’ll pay taxes only when you withdraw—likely at a lower rate if you retire in a lower bracket.

Balancing Risk and Reward

Though tax perks are appealing, approved investments carry market risk.

Diversification remains essential.

For retirement accounts, a mix of equities, bonds, and real estate can balance growth and stability.

Preserving capital is key for education and health accounts earmarked for specific costs.

Conclusion

Approved investments can cut tax liability, yet they work best strategically and alongside a larger financial plan.

Maximizing contributions, harvesting losses, timing withdrawals, and monitoring policy shifts can lower taxes and build financial resilience.

Whether saving for retirement, a child’s education, or a future home, grasping approved investment tax benefits leads to smarter, tax‑efficient choices.

- 이전글กรณีศึกษา: ร้านดอกไม้งานศพกรุงเทพ - การจัดการธุรกิจในช่วงเวลาที่เศร้าโศก 25.09.13

- 다음글Glory Casino App Download for ZTE Devices 25.09.13

댓글목록

등록된 댓글이 없습니다.