Constructing a Tax-Resilient Business Framework

페이지 정보

본문

When entrepreneurs launch a new venture, the focus is almost always on product, market fit, and growth. However, the tax landscape can determine a company’s financial fate. A tax‑resilient framework foresees tax obligations, aligns structures with enduring strategy, and capitalizes on legal incentives without breaching compliance. Presented below is a pragmatic roadmap for creating such a model.

1. Start with a Clear Mission and Fiscal Vision

A tax‑resilient approach starts with a mission that incorporates fiscal prudence. Ask yourself: "How will taxes affect our runway?" and "What is our risk tolerance for audit or penalties?" This sets the tone for all later decisions.

2. Decide on the Right Entity Early

• Sole Proprietorship or Partnership – Easier tax filings yet expose personal assets.

• Limited Liability Company (LLC) – Grants flexibility: may opt for pass‑through or corporate tax treatment.

• C‑Corporation – Permits lower corporate tax rates (currently 21%), stock‑based rewards, and possible tax‑advantaged dividends.

• S‑Corporation – Pass‑through entity but limited to 100 shareholders and must be U.S. citizens or residents.

Evaluate capital structure, investor expectations, and growth plans. Typically, a hybrid model (e.g., an LLC owning a C‑Corp subsidiary) lets you gain both flexibility and tax advantages.

3. Chart Tax Obligations Early

• Federal Income Tax – Core responsibility.

• State and Local Taxes – Sales tax, franchise tax, corporate tax, payroll taxes.

• International Taxes – If you operate internationally, factor in transfer pricing and foreign tax credits.

Build a tax calendar that records filing deadlines, estimated payments, and audit windows. Employ software or a tax expert to automate reminders.

4. Exploit Tax Credits and Incentives

• Research & Development Credit – Typical for tech startups.

• Energy Efficiency Credits – For green buildings or renewable installations.

• Work Opportunity Tax Credit (WOTC) – Incentivizes hiring from targeted groups.

• Economic Development Zones – Offer tax abatements for businesses in designated areas.

Carry out a quarterly audit of eligible credits. Even minor dollar savings can prolong the runway.

5. Strategize Capital Gains and Dividends

• Holding Companies – Storing profits in a holding company lets you postpone dividend payouts and defer tax until distribution.

• Qualified Small Business Stock (QSBS) – If you plan to raise capital, structuring shares as QSBS can exempt up to 100% of gains under Section 1202 for up to 10 years.

• Capital Gains Timing – Use loss harvesting and asset rebalancing to offset gains.

Implement loss harvesting and asset rebalancing to offset gains.

6. Enhance Payroll and Compensation Structures

• Salary vs. Equity – A modest salary maintains compliance with employment laws, while equity rewards founders and employees.

• Deferred Compensation Plans – 401(k), SEP IRA, or defined contribution plans reduce taxable income now while securing future benefits.

• Expense Reimbursement Policies – Well‑defined rules prevent "under‑reporting" pitfalls that might cause penalties.

Clearly defined rules avoid "under‑reporting" pitfalls that can trigger penalties.

7. Establish Robust Record‑Keeping and Documentation

• Digital Accounting System – Merge point‑of‑sale, invoicing, payroll, and expense tracking.

• Audit Trail – Maintain receipts, contracts, and correspondence for at least seven years (or longer for property and capital assets).

• Internal Controls – Divide duties, authorize spending, and review transactions quarterly.

Segregate duties, authorize spending, and review transactions quarterly.

8. Grasp Transfer Pricing and Intercompany Agreements

If you run multiple subsidiaries, establish arm’s‑length prices for goods, services, and intellectual property. Record the methodology (e.g., comparable uncontrolled price, resale price, cost‑plus) and submit the necessary forms (e.g., IRS Form 8824 for C‑Corp, IRS Form 8891 for EICs).

9. Anticipate Audits and Dispute Resolution

• Tax Dispute Strategy – Recognize potential dispute areas (e.g., depreciation methods, foreign tax credit eligibility).

• Professional Representation – Secure a CPA or tax attorney early.

• Tax Contingency Fund – Set aside 2–3% of projected profit for unforeseen audit costs.

Reserve 2–3% of projected profit to cover unexpected audit expenses.

10. Review and Update Regularly

Tax regulations evolve rapidly. Arrange an annual tax review with a qualified professional. Adjust entity structure, credit usage, and expense allocation to align with new regulations.

Case Study Snapshot

Consider a SaaS startup that incorporated as an LLC in Delaware but formed a C‑Corp subsidiary to hold all intellectual property. The LLC chooses partnership taxation, letting founders receive operating profits pass‑through without corporate tax. Simultaneously, the C‑Corp enjoys the 21% corporate rate and retains earnings to finance R&D, thereby qualifying for the R&D credit. By issuing stock options to employees, the company conserves cash while aligning incentives. Their payroll is meticulously structured: a modest base salary, milestone‑linked quarterly bonus, and deferred compensation. All expenses are logged in a cloud‑based system, ensuring a flawless audit trail. When the IRS audits, the company can point to well‑documented transfer pricing, proper credit claims, and a clear audit trail, resulting in a swift resolution with minimal penalties.

Bottom Line

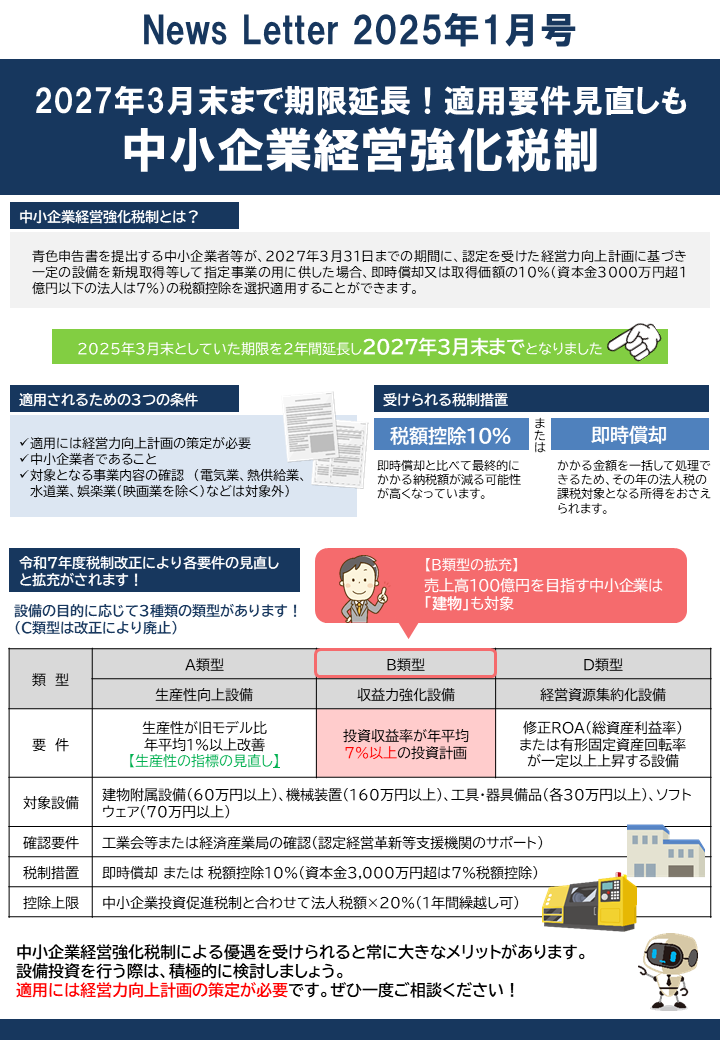

A tax‑resilient model isn’t about evading taxes; it’s about syncing tax strategy with business strategy. Opting for the appropriate entity, charting obligations, capitalizing on incentives, and preserving detailed records enables entrepreneurs to safeguard cash flow, attract investors, 中小企業経営強化税制 商品 and foster growth without looming tax troubles. Building a strong tax foundation returns dividends—literal and figurative—through all phases of the company’s lifecycle.

- 이전글'Biggest Loser' Star Dolvett Quince Debates Best Diets With Bethenny Frankel 25.09.12

- 다음글How to Maximize Your Winnings at Thailand's Online Slot Casinos 25.09.12

댓글목록

등록된 댓글이 없습니다.